The cashflow and accounting system consequences of deciding that an expense was not a legitimate business expense

First, we need to divide this into a couple of situations.

What should happen to a declined expense?

If one of your team has expensed something on a company card that doesn't fit your policies, the result should be that they pay back the business. To record this, we require you push the expense to a specific accounting code. From there, we recommend that you contact the employee to arrange for a repayment of their debt. If the expense has occurred on a personal card and the employee is seeking reimbursement, the result is simple - you don't reimburse them and the expense stays off your company's books.

What if I don't have a suitable accounting code for this purpose?

For Xero-connected users:

We pull your accounting codes from your Xero chart of accounts. We recommend heading to Xero's chart of accounts page and creating a new account called "Employee Spend Recoveries".

For users of other accounting systems:

Your accounting codes are generated in Paytron using Custom Categories, so we recommend heading to your Categories page and creating a new category called "Employee Spend Recoveries" under the Expense category group.

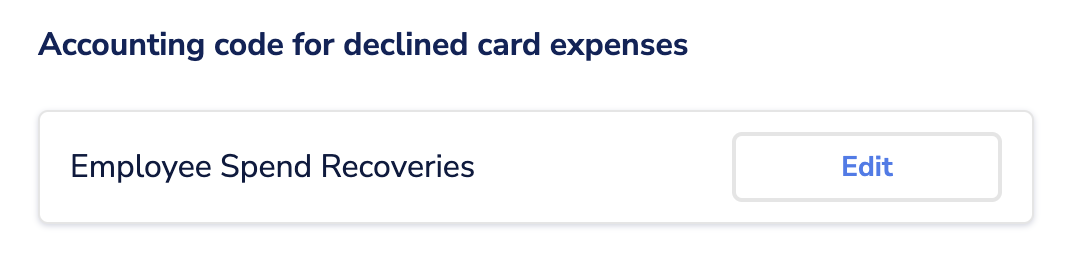

Once you've done this, please visit the prompt below on the Setup > Account page to select the newly created accounting code.